SINGAPORE, May 6, 2025 – Southeast Asia could unlock a new era of sustainable growth and resilience by adopting a systems-based approach to green economic development, according to the latest edition of Southeast Asia’s Green Economy report, released today by Bain & Company, GenZero, Google, Standard Chartered, and Temasek.

Now in its sixth edition, the report underscores how macroeconomic uncertainties are prompting policymakers, businesses and investors across the region to reconsider growth strategies. The proposed systems-based approach identifies and tackles systemic barriers that cut across economic sectors, prioritising interconnected solutions with the greatest potential for scale and long-term impact.

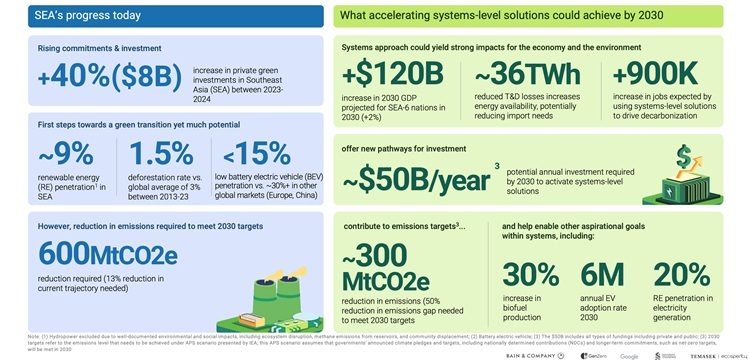

The analysis estimates that the six key economies in the region — Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam (collectively SEA-6) — could realise up to USD 120 billion in additional GDP (+2%), generate 900,000 new jobs, and close 50% of the projected emissions gap by 2030.

“Conventional wisdom suggests macro uncertainty may slow the green transition. But in fact, Southeast Asia, and the wider Asia-Pacific, can use this moment to accelerate transformation,” said Dale Hardcastle, Partner and Co-director of Bain & Company’s Global Sustainability Innovation Center. “The region must pursue dual goals: economic growth and emissions reduction, turning this challenge into an opportunity for long-term prosperity.”

Regional Collaboration Critical

The report emphasises the importance of deeper collaboration between Southeast Asia and the broader Asia-Pacific region. Strong trade ties, shared energy security concerns, and cross-border investment flows create fertile ground for collective action on the energy transition.

Asia-Pacific is responsible for half of global greenhouse gas emissions, with SEA accounting for 7.5%. Despite ambitious pledges, both regions are falling short of their 2030 climate targets, and without urgent intervention, the emissions gap is expected to widen.

“We have five years left to meet 2030 climate goals. It’s imperative that we prioritise pragmatic, systems-level solutions with near-term results,” said Franziska Zimmermann, Managing Director, Sustainability at Temasek.

Three Key Systems for Green Growth

The report identifies three priority systems crucial for Southeast Asia’s green economy:

- Sustainable Bioeconomy

Agriculture and land use contribute up to 30% of SEA-6 emissions, largely due to unsustainable practices in commodities like palm oil and rubber. Barriers include fragmented supply chains, weak land rights, and underdeveloped carbon markets. Reforms—ranging from improving agricultural productivity to enabling land use innovation—could unlock immense value. Regional cooperation in innovation, investment, and carbon pricing would further amplify gains. - Next-Generation Grid Development

To decarbonise effectively, the region must expand and modernise its power grids to integrate renewables, storage, and distributed energy solutions. Cross-border electricity trading and regulatory reforms could reduce the cost of decarbonising grids by 11% by 2050. Green industrial clusters can catalyse investment and accelerate infrastructure deployment. - Electric Vehicle (EV) Ecosystem

Road transport is a major emissions source, and SEA lags in EV adoption. With 80% of its vehicle production still focused on internal combustion engines, the region risks being left behind. A dual strategy—scaling local EV demand and domestic manufacturing—is needed. Cross-border supply chains for batteries and EV components could unlock shared value and competitiveness.

Enablers: Finance, Carbon Markets, and AI

The report outlines three enabling areas to support systems transformation:

- Climate and Transition Finance: Despite growth in green investments — up 43% to USD 8 billion in 2024 — SEA faces a USD 50 billion funding gap. Blended finance and policy reform are essential to scale capital flows and attract institutional investors.

“The opportunity to finance Southeast Asia’s transition is compelling,” said Chow Wan Thonh, Head of Coverage, Singapore and ASEAN, Standard Chartered. “We are committed to supporting clients as they shift to sustainable business models.” - Carbon Markets: SEA’s voluntary carbon market is evolving, but it must scale rapidly. Stable demand, robust registries, and compliance schemes are vital.

“We need high-integrity carbon credits supported by predictable policies to attract investment,” said Anshari Rahman, Director of Policy and Analytics at GenZero. “Meeting ICVCM and CORSIA standards will be key.” - Artificial Intelligence: Data centres, driven by rising AI workloads, could contribute up to 2% of SEA emissions. However, AI also presents an opportunity to reduce emissions by 3–5% in key sectors like power, transport, and agriculture. Investment in sustainable infrastructure and emissions-cutting applications is essential. “We must optimise AI’s energy use while also leveraging its potential to drive decarbonisation,” said Spencer Low, Head of Regional Sustainability, APAC, Google.

Investment Trends

Green investments in SEA-6 surged to USD 8 billion in 2024, driven largely by the solar and waste sectors. Malaysia and Singapore led the charge, accounting for over 60% of deal activity. Foreign direct investment from outside APAC tripled, while intra-APAC investment doubled. However, domestic investment in SEA-6 declined 40%, highlighting the need for renewed focus on homegrown capital mobilisation.

Despite these mixed trends, infrastructure and climate funds significantly expanded their presence in the region, indicating rising confidence in the sector’s long-term prospects.

From Targets to Action

The report concludes that Southeast Asia’s green transition must now shift from pledges to action. A systems-based approach offers a practical roadmap to deliver on climate goals while also creating economic opportunities.

“Decarbonisation is no longer a cost centre, it’s a strategic growth lever,” the report states. “With coordinated action, Southeast Asia can build a green economy that delivers lasting value for people, planet, and prosperity.”